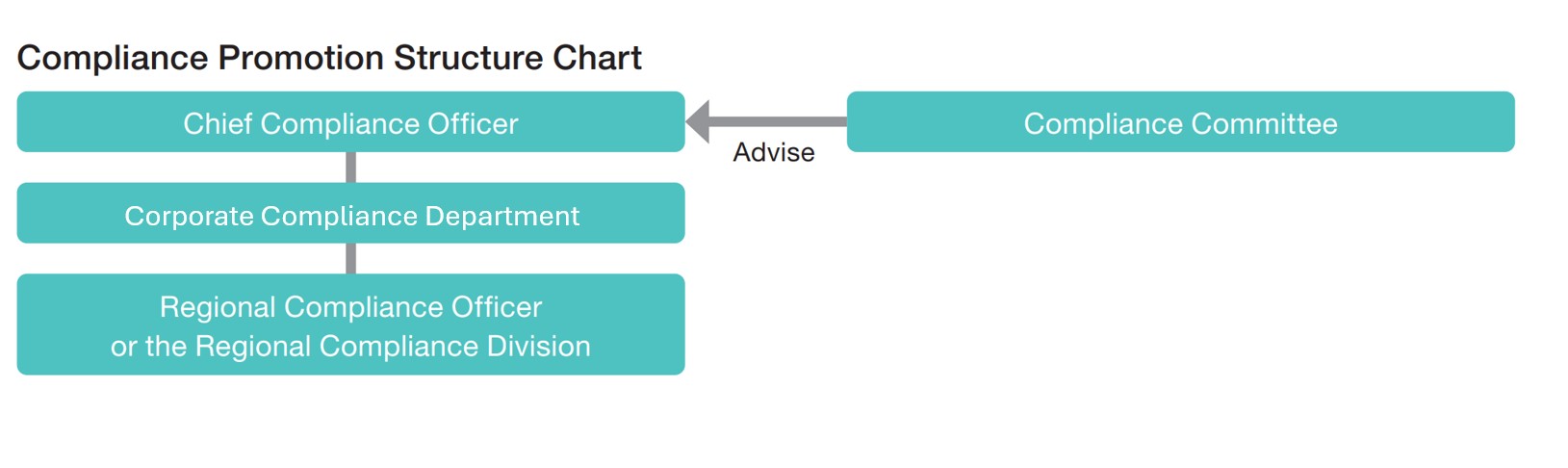

Compliance Promotion

Eisai promotes its compliance program that consists of delivering the message of top management, developing the Code of Conduct and other relevant rules, conducting educational activities, establishing a training system as well as providing consultation services by defining compliance as “the observance of the highest legal and ethical standards” and positioning it at the core of management activities. Based on a lesson from the international vitamin E cartel, Eisai started to promote full-fledged compliance in FY 2000. These compliance promotion programs periodically undergo objective reviews by Compliance Committee that consists of outside experts such as lawyers and consultants from Japan and overseas.

1. Establishment of Code of Conduct and Other Relevant Rules and Conducting Educational Activities to Foster Compliance Awareness

Eisai has been publishing Compliance Handbook, which outlines Eisai Network Companies (ENW) Charter of Business Conduct and the Code of Conduct, to cultivate the compliance awareness. For all officers and employees in all Eisai network companies, this handbook is available in 16 languages.

All officers and employees not only participate in training to understand contents described in Compliance Handbook, but also swear to comply with it every year.

In addition, with the aim of raising compliance awareness and preventing incidents from happening , we continuously conduct various training programs utilizing different formats, such as compliance workshops for corporate officers, e-learning trainings for all corporate officers and employees, and workshop training materials for each department.

Compliance Awareness Survey

In order to grasp the compliance and organizational culture and matters that we must tackle, we conduct an All-ENW Compliance Awareness Survey every other year. The survey analyzes and evaluates ENW officers and employees on their awareness and activities concerning compliance. We utilize the results of the survey to further improve our compliance programs and also share the results with the corporate officers and department managers, leading to their voluntary actions to resolve matters identified.

2. Use of Compliance Counter

The Compliance Counter serves as a point of contact for whistle-blowing in ENW. It has been set up regionally, including in Japan, the United States, Europe, China, and Asia, in addition to being a global contact point for consultation and whistle-blowing that allows parties around the world to contact Japan directly in their local languages. The Company has also established outside consultation desks staffed by independent outside attorneys and outside consultation desks operated by neutral ombudspersons to handle problems related to work and the workplace, fostering an environment that makes whistle-blowing easier.

The Compliance Counter accepts not only whistle-blowing reports but also provides all sorts of consultations such daily activities regarding compliance. In FY 2021, Compliances Counter at Eisai Headquarters received more than 320 inquiries.

3. Prevention of Bribery and Corruption

Based on its strong determination to undertake honest business activities, Eisai formulated the Corporate Anti-Bribery and Anti-Corruption (ABAC) Policy for Eisai network companies in January 2012 (revised on October 1, 2018). This policy provides common rules for Eisai network companies when dealing with external parties in line with efforts to carry out business activities without bribery or corruption across the Eisai network companies.

As one concrete initiative, Eisai introduced the ABAC due diligence system that uses a web-based system for receiving responses to a globally common questionnaire on the possibility of bribery and corruption that is sent out beforehand to companies with which we plan to newly undertake transactions. By using this system, we have already achieved certain results in reducing risk associated with new business transactions. Based on the thinking of a risk-based approach, this system is being operated in the Americas region that includes Mexico, Brazil and Canada; the EMEA region that encompasses Russia and Eastern Europe; China, India, and countries in Asia.

Additionally, Eisai is moving ahead with the advanced introduction of a system at overseas subsidiaries that detects signs of potential fraud by monitoring accounting and financial data.

4. Compliance-based promotion

Eisai conducts ethical promotion globally in accordance with compliance requirements. We disclose information on payments to medical institutions and patient groups, in accordance with the Japan Pharmaceutical Manufacturers Association (JPMA) guidelines, and the regulations and guidelines of each country in order to have broad societal understanding that our corporate activities are undertaken based on the highest ethics.

■Setting Forth a Code of Conduct in the Compliance Handbook

Eisai has set forth a code of conduct in the Compliance Handbook that is distributed to all employees to ensure compliance-based promotion. The following is an excerpt from the handbook.

-

Eisai markets and promotes its pharmaceutical products worldwide. We provide accurate and balanced scientific information, and promote our products only for the uses for which they have been approved by the applicable regulatory authorities.

-

“Promotion” means any activity undertaken, organized, or sponsored by a pharmaceutical company which is directed at Healthcare Providers (HCPs) to promote the prescription, recommendation, supply, administration, or consumption of its pharmaceutical products through all methods of communication, including the Internet.

-

When engaging in promotional activities with HCPs, we are expected to be familiar with local laws and regulations for such engagements in our home country.

- Promotion in a manner not consistent with the approved label is prohibited and promotion of drugs prior to approval is also prohibited. All promotional materials must be reviewed and approved in accordance with local processes and may be used only for the approved purpose.

■Formulation of Eisai Co., Ltd. Code of Practice

In March 2012, the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) announced the “IFPMA Code of Practice” (“IFPMA Code”) as a code covering not only marketing activities but also interactions with healthcare professionals, medical institutions and patient organizations, as well as the promotion of medicines. In line with the intent of the IFPMA Code, the “JPMA Code of Practice” was established and implemented by the JPMA. Then Eisai, as a member of JPMA, established the “Eisai Co., Ltd. Code of Practice” in line with the aforementioned Code. All the executives and employees at Eisai engage in corporate activities with the aim of earning the trust from society by ensuring high level of transparency, ethics and corporate accountability in corporate activities involving researchers, healthcare professionals and patient organizations.

■Compliance Test

This is a set of questions that Eisai Group officers and employees ask themselves when they are unsure of a decision.

1. Could you openly tell your family what you have done?

2. Do you think it’s acceptable to be non-compliant as long as you are not found out?

3. How would it feel to read a report of your activities in the news or on social media?

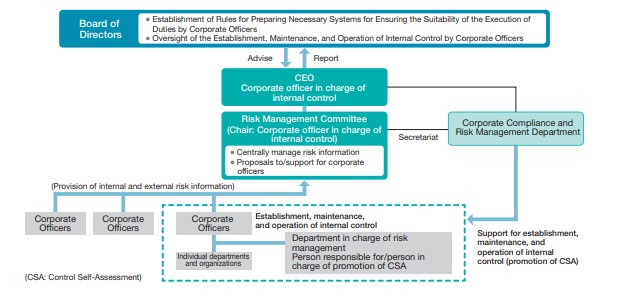

Promoting Risk Management

1. Risk Management System

Eisai’s Board of Directors has established “Rules for Preparing Necessary Systems for Ensuring the Suitability in the Performance of Duties by Corporate Officers” in accordance with the stipulations of the Companies Act. These Rules stipulate that all corporate officers must identify risks in their assigned duties and build, maintain, and operate internal controls. The Corporate Officer responsible for Internal Control has established a global “ENW Internal Control Policy”. They also promote the creation, maintenance, and operation of internal controls throughout the Group, and work to manage risks within the allowable range. Based on an annual plan, the Internal Audit department verifies the development, maintenance, and operation of internal controls as defined in the “ENW Internal Control Policy”, leading to continuous improvement.

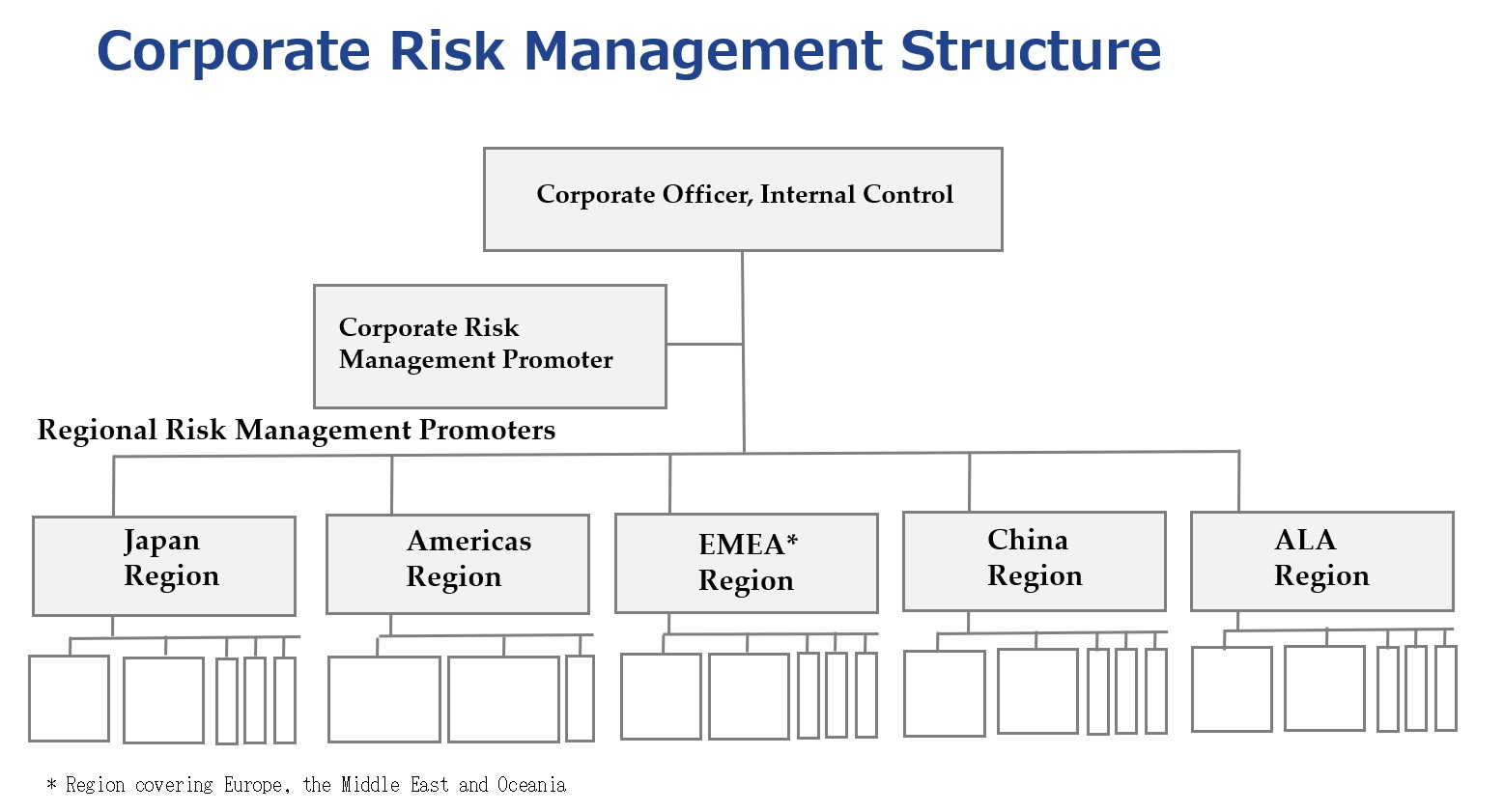

Corporate Risk Management department works collaboratively with Regional Risk Management Promoter to support the development, maintenance, and operation of internal controls throughout the Group.

In order to deliver appropriate risk management across the organization, Eisai implements annual CSA (Control Self-Assessment) at the global level, identifying and assessing risks throughout the company. The Risk Management Committee examines risks identified though CSA or those crucial to the entire company and confirms the status of those risks and risk management, striving to prevent those risks from materializing.

2. Risk Management Promotion

The Corporate Officer responsible for Internal Control supervises the system as a whole, while the Risk Management department supports actual business operations in the five regions.

The Corporate Officer responsible for Internal Control supervises the promotion of the development, maintenance, and operation of internal controls throughout the Group. The Risk Management department undertakes the actual implementation of this promotion. The department furthers the development, maintenance, and operation of internal control with Risk Management Promotion Officers in each region, who are appointed by the Corporate Officer responsible for Internal Control.

3.CSA (Control Self-Assessment)

CSA (Control Self-Assessment) is being implemented as a tool for appropriate risk management across the Group. For CSA, the head of each ENW company identifies and evaluates risks in their organization, and then addresses these risks as appropriate. From FY2024, each corporate officer has taken the lead in implementing CSA, aiming to further analyze each identified risk and enhance the planning and implementation of countermeasures. Eisai enhances the effectiveness of its risk management by developing an understanding of its critical risks through risk identification and evaluation by all corporate officers and following-up on the status of responses to those risks.

4.The Risk Management Committee

The Risk Management Committee holds regular meetings ( monthly, and quarterly as a global meeting), with the Corporate Officer responsible for Internal Control as the chair and with advice from the Board of Directors, to centrally manage the risks that are deemed to be particularly important. Further, the Committee promotes identification of risks and prompt, efficient risk response. In addition, the Committee strives to detect potential risks to the Company at an early stage, in light of outside corporate scandals, etc., and implements measures to prevent those risks from being actualized.

●The methods to decide critical risks to be followed by the Risk Management Committee

1) Corporate officers determine critical risks from those identified, and thereafter follow up on the management status of those important risks and conditions of internal control to ensure given risks are controlled within acceptable levels.

Critical risks are determined generally through following processes.

(1) The Secretariat of the Risk Management Committee (hereinafter referred to as Secretariat) assesses all critical risks identified by corporate officers, and selects candidates for critical risks based on internal controls related to multiple corporate officers and departments.

(2) When the Secretariat determines candidates for critical risks, it must have a sufficient understanding of, and give enough consideration to, the internal situation of the Company.

2) Risks listed as candidates for critical risks are assessed from a comprehensive perspective, such as utilizing risk maps, to determine critical risks. When concerns arise over a new risk due to changes in the external environment or business promotion, the Secretariat, under the instruction of the committee chair, obtains detailed information about the risk. This is achieved by requesting corporate officers to submit a critical risk report or by conducting an interview with them. The information collected is then reported to the committee chair.

3) Regardless of the aforementioned processes, the committee chair can determine critical risks and report them to the committee.