❶Determination of Compensation, etc.

Compensation paid to directors and corporate officers is determined by the Compensation Committee. All members of the Company’s Compensation Committee are outside directors, and the Committee places emphasis on an objective perspective and transparency. The Compensation Committee has the authority to determine the details of the individual compensation of the Company’s directors and corporate officers, primarily with respect to the following matters

-

1.Basic policy concerning details of individual compensation paid to directors and corporate officers

-

2.Details of individual compensation paid to directors and corporate officers

-

3.Determination of evaluation based on the attainment of Company-wide performance targets and the individual performance targets of each corporate officer with respect to the determination of performance-based compensation for corporate officers

❷Process of Determining the Compensation System

The Compensation Committee examines various issues concerning the compensation paid to directors and corporate officers, confirms the level of compensation each year, and determines the compensation system for the following year. The Compensation Committee actively incorporates and utilizes data and other information from external professional organizations (such as the “Executive Compensation Database” of Willis Towers Watson) in examining various issues related to compensation, etc., and in researching and examining the level of compensation, etc.

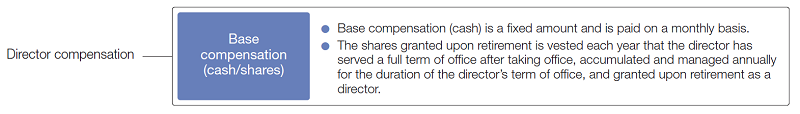

❸Compensation, etc., for Directors

-

1)Basic Policy Concerning Compensation, etc., Paid to Directors

The basic policy concerning compensation, etc., paid to directors shall be as follows.

Set the compensation, etc., of directors so that the contents are suitable to motivate them to fully carry out their management oversight function, which is their duty, in order to improve the common interests of stakeholders and increase long-term corporate value.

A portion of compensation, etc., paid to directors consists of stock, from the perspective of sharing the same profit-consciousness as our Shareholders. -

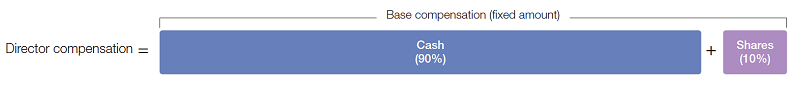

2)Compensation System for Directors

- Compensation, etc., paid to directors is only a fixed base compensation (cash and stock).

- The level of base compensation of outside directors and inside directors is aimed at the upper middle range for the industry.

- The Chair of the Board of Directors and each Committee Chair receive additional compensation for their service as Chair.

- The proportion of compensation, etc., for directors is as shown below.

- Compensation, etc., paid to directors is only a fixed base compensation (cash and stock).

❹Compensation, etc., for Corporate Officers

-

1)Basic policy concerning compensation, etc., paid to Corporate Officers

The basic policy concerning compensation, etc., paid to corporate officers shall be as follows.

-

1.Set the contents of the compensation, etc., of corporate officers to be competitive, with the importance and heaviness of the duties assigned to the corporate officer sufficiently reflected. This will make it possible to contribute to achievement of the hhc concept, attract excellent human resources that can play an active role globally, and improve the morale of corporate officers regarding execution of business.

-

2.Determine the compensation, etc., of corporate officers with weight placed on performance/outcomes obtained as a result of fulfilling the Company’s Charter of Business Conduct as an hhceco company as stipulated in the Articles of Incorporation. This will increase the convincingness of the compensation of members of the management team.

-

3.Set the contents of the compensation, etc., of corporate officers so that they are strongly motivated to contribute not only to short-term performance based on the results of each fiscal year, but also to improvement of the Company’s medium- to long-term corporate value, achievement of social good, and the sustainability of society. This will respond broadly to the expectations of stakeholders and contribute to achievement of the Corporate Concept.

-

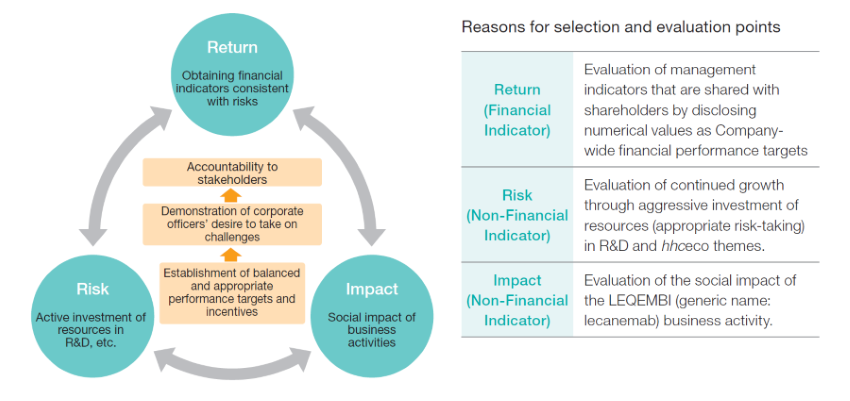

4.Determine compensation, etc., of corporate officers using objective and suitable evaluation criteria and a transparent and fair process, after setting appropriate performance targets and incentives that strike a balance between “risk, return, and impact.”* Through this, set fair and convincing contents of compensation and motivate corporate officers to take on challenges, while being accountable to stakeholders.

* Risk (aggressive investment of resources, etc., in research and development, etc.), return (Company-wide financial performance indicators), and impact (the social impact of business activities)

-

-

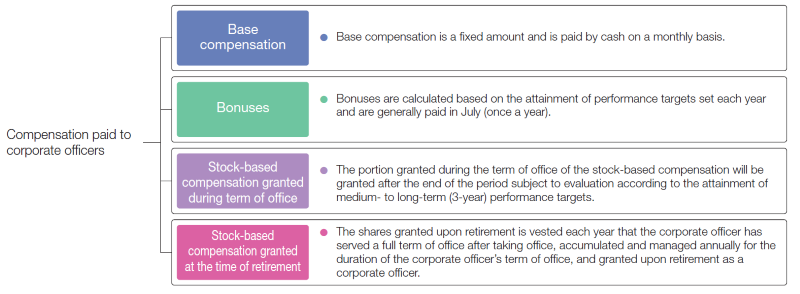

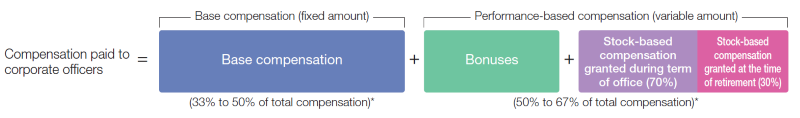

2)Compensation System for Corporate Officers

- The compensation, etc., of corporate officers consists of base compensation (fixed amount) and performance-based compensation (variable amount) in the form of bonuses and stock-based compensation (portion granted during the term of office and portion granted upon retirement).

- The proportion of compensation, etc., for directors is as shown below.

* The ratio of the base compensation and performance-based compensation of corporate officers from overseas subsidiaries is set in accordance with the market data for each country, so actual amounts may differ from those given in the figure.

- The compensation, etc., of corporate officers consists of base compensation (fixed amount) and performance-based compensation (variable amount) in the form of bonuses and stock-based compensation (portion granted during the term of office and portion granted upon retirement).

-

The contents of the compensation, etc., of corporate officers are set by global job grade and at a level intended to be in the upper middle range for the industry, in order to make the contents of compensation, etc., competitive, with the importance of corporate officers’ duties and the size of their responsibilities reflected.

- Job Grade of Corporate Officers

- An indicator of the size of the required duties and the standard for determining compensation, etc.

- The job grades of corporate officers are determined by using the Willis Towers Watson Global Grading System to measure job grades in an objective manner, and reflecting the Company’s own evaluation of job responsibilities, etc., on the objectively measured job grades.

In order to sufficiently reflect Company-wide performance in management compensation, performance-based compensation is aimed to constitute at least 50% of total compensation, using a mechanism that increases its percentage of total compensation as the job grade gets higher.

(1) Bonuses

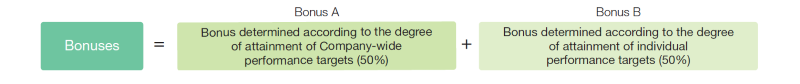

Bonuses consist of bonuses that are determined based on the degree of attainment of Company-wide performance targets (Bonus A) and bonuses that are calculated based on the degree of attainment of individual performance targets (Bonus B). The ratio of the base amount for calculation of Bonus A and Bonus B shall be 50:50.

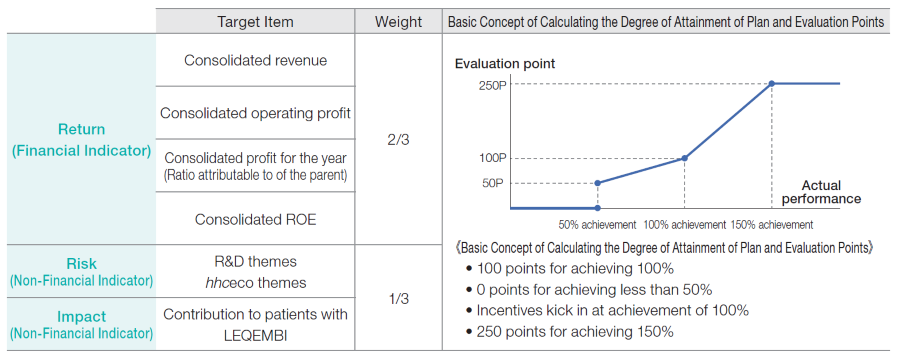

The degree of attainment of Company-wide performance targets for Bonus A is determined based on an evaluation of financial indicators (return) and non-financial indicators (risk and impact), and Bonus A is paid in a range of 0% to 250%.

《Company-wide Performance Targets, etc.》

The degree of attainment of individual performance targets for Bonus B is determined based on an evaluation of the individual performance targets, and the bonus is paid in the range of 0% to 150%. The individual performance targets of all corporate officers include at least 20% of the targets in the following aspects as social good targets for the realization of the corporate image stipulated in the Articles of Incorporation.

- DE&I (Diversity, Equity, & Inclusion) initiatives

- Ensuring cyber security to protect patient information and ensure a stable supply

- Contributing to social impact through improved access to pharmaceuticals

(2) Stock-based compensation

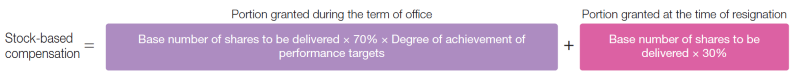

Stock-based compensation for Corporate Officers consists of a portion to be granted during term of office and a portion to be granted upon retirement.

The portion to be granted during term of office is performance-linked compensation that is linked to medium- to long-term (3-year) business performance. The portion to be granted upon retirement is performance-linked compensation that is vested each year that a full-term is served and is linked to the stock price at the time of retirement.

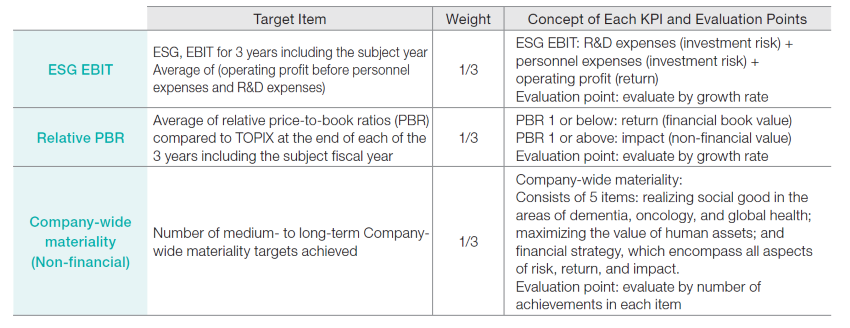

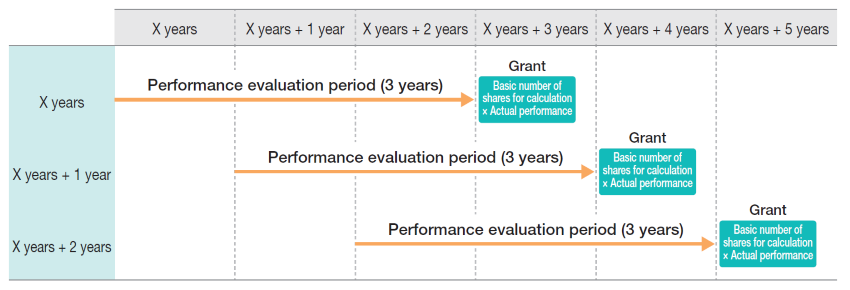

The portion granted during the term of office is performance-based compensation that can reflect medium- to long-term performance and contributions to ESG. The 3 evaluation indicators are listed in the table below, and are designed to ensure objectivity and transparency by balancing the concept of performance targets of “risk, return, and impact” as stated in the Basic Policy on Compensation, etc. for Corporate Officers, and by reflecting medium- to long-term performance in a simple and appropriate manner. The evaluation period is set at 3 years. The portion granted during the term of office will range from 0% to 150% based on the attainment of these goals.

《Shares issued for the portion granted during the term of office》

* Each year, the number of shares that will form the basis for the granting of shares (the basic number of shares for calculation) is determined, and the shares are granted after the completion of the 3-year evaluation period, reflecting the evaluation of performance.

The portion granted upon retirement is vested each year that the corporate officer has served a full term of office after taking office, accumulated and managed annually for the duration of the corporate officer’s term of office, and granted upon retirement as an officer. If the term of office as an officer is less than 3 years, the officer is not eligible.

❺Other Matters Relating to the Compensation System

-

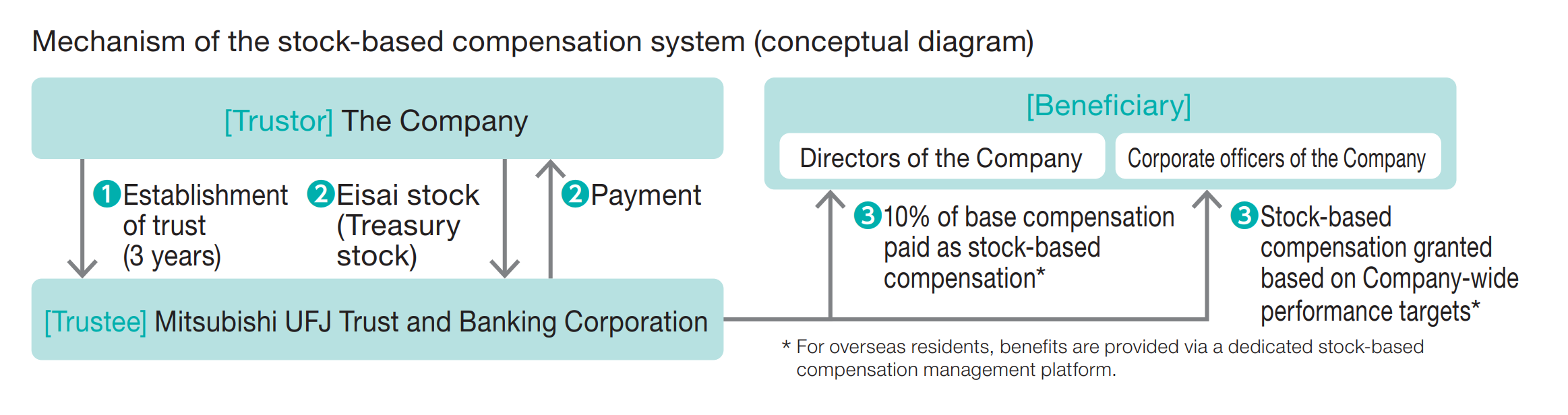

1)Performance-Based Stock-Based Compensation System

The Company’s performance-based stock-based compensation system allocates treasury shares through a third-party allocation by resolution of the Board of Directors to the Officer’s Compensation BIP (Board Incentive Plan) Trust account.

-

Company regulations prohibit directors and corporate officers from selling Eisai stock while in office and until at least 1 year after the individual has left that position.

-

2)Malus and Clawback Clause

In the event that a director or corporate officer violates relevant laws, regulations, or internal rules and on certain other grounds, the Compensation Committee may, based on a resolution of the Compensation Committee, reduce its base compensation and performance-based compensation, suspend payment of such compensation, or demand a refund.