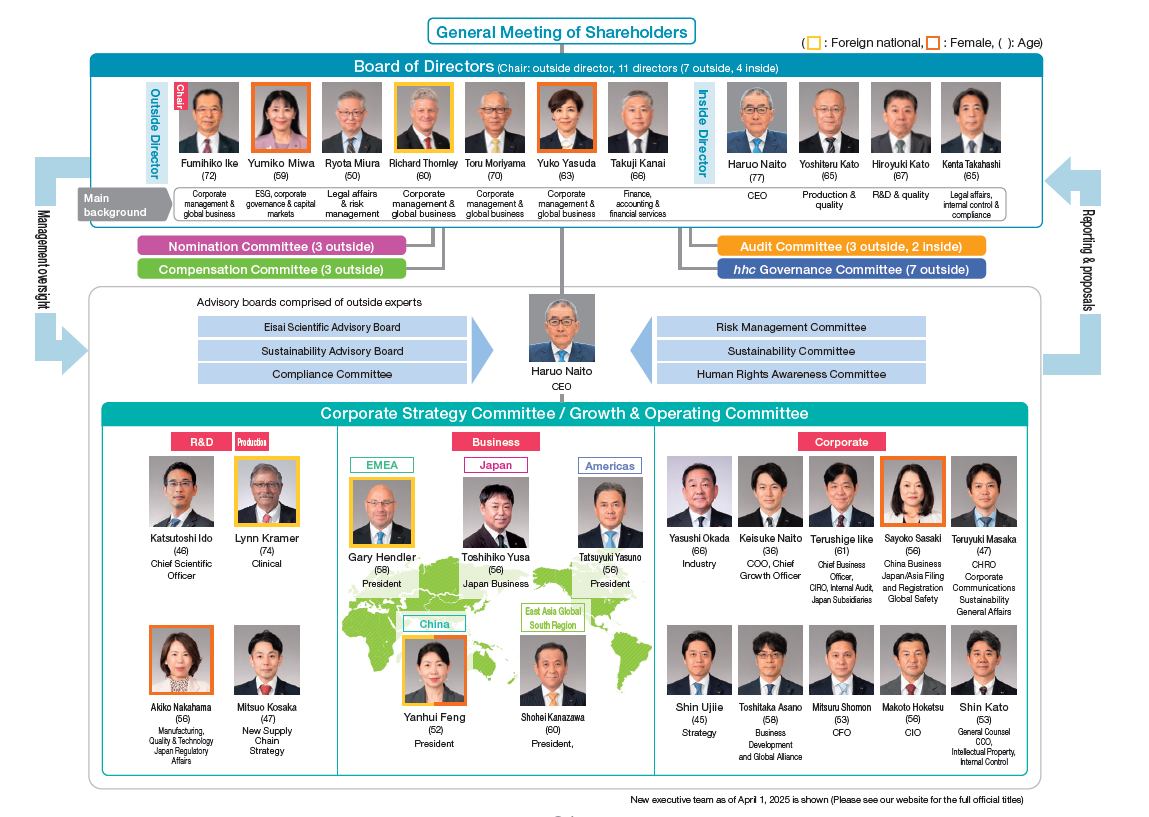

Eisai's Corporate Governance System

Features of the Company’s Corporate Governance

- Clear Separation of the Functions between Oversight of Management and the Execution of Business

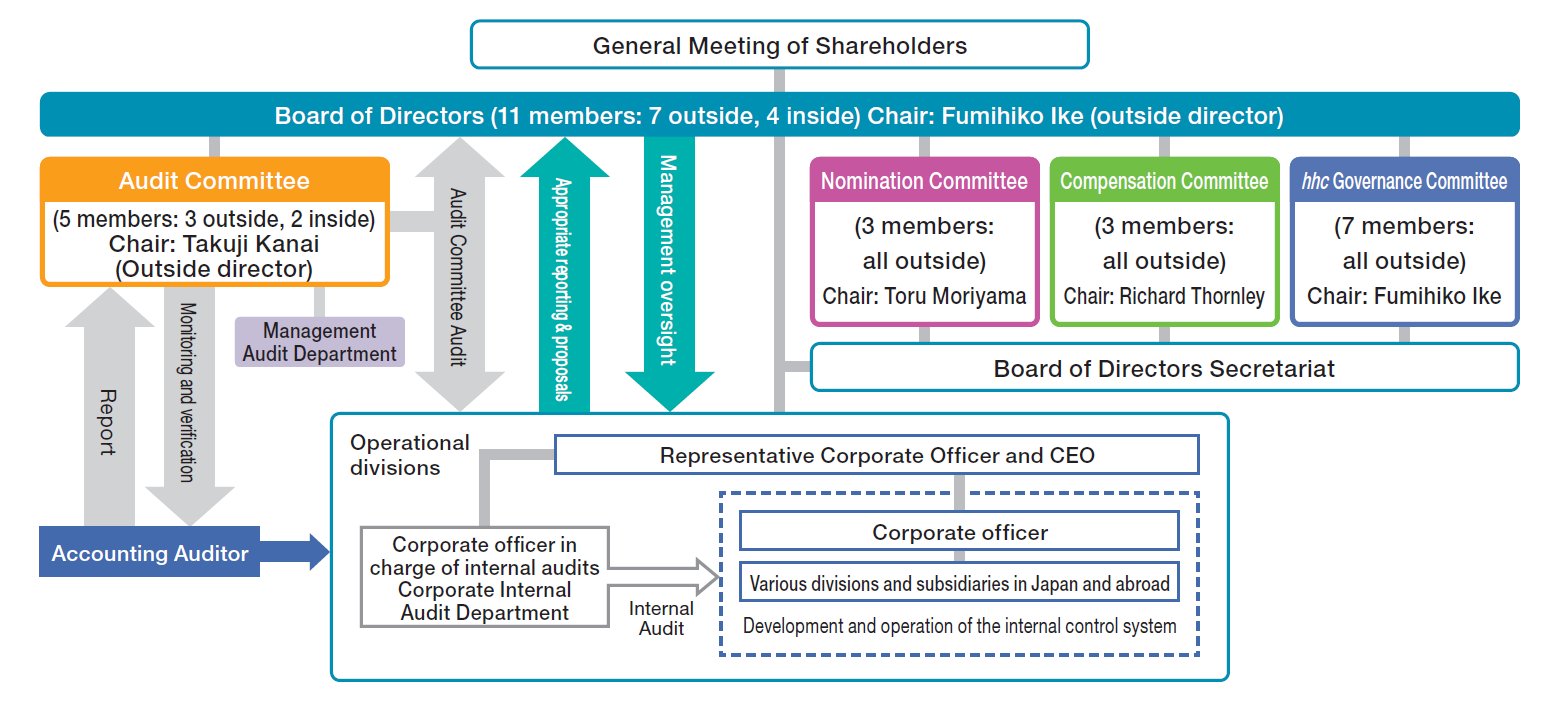

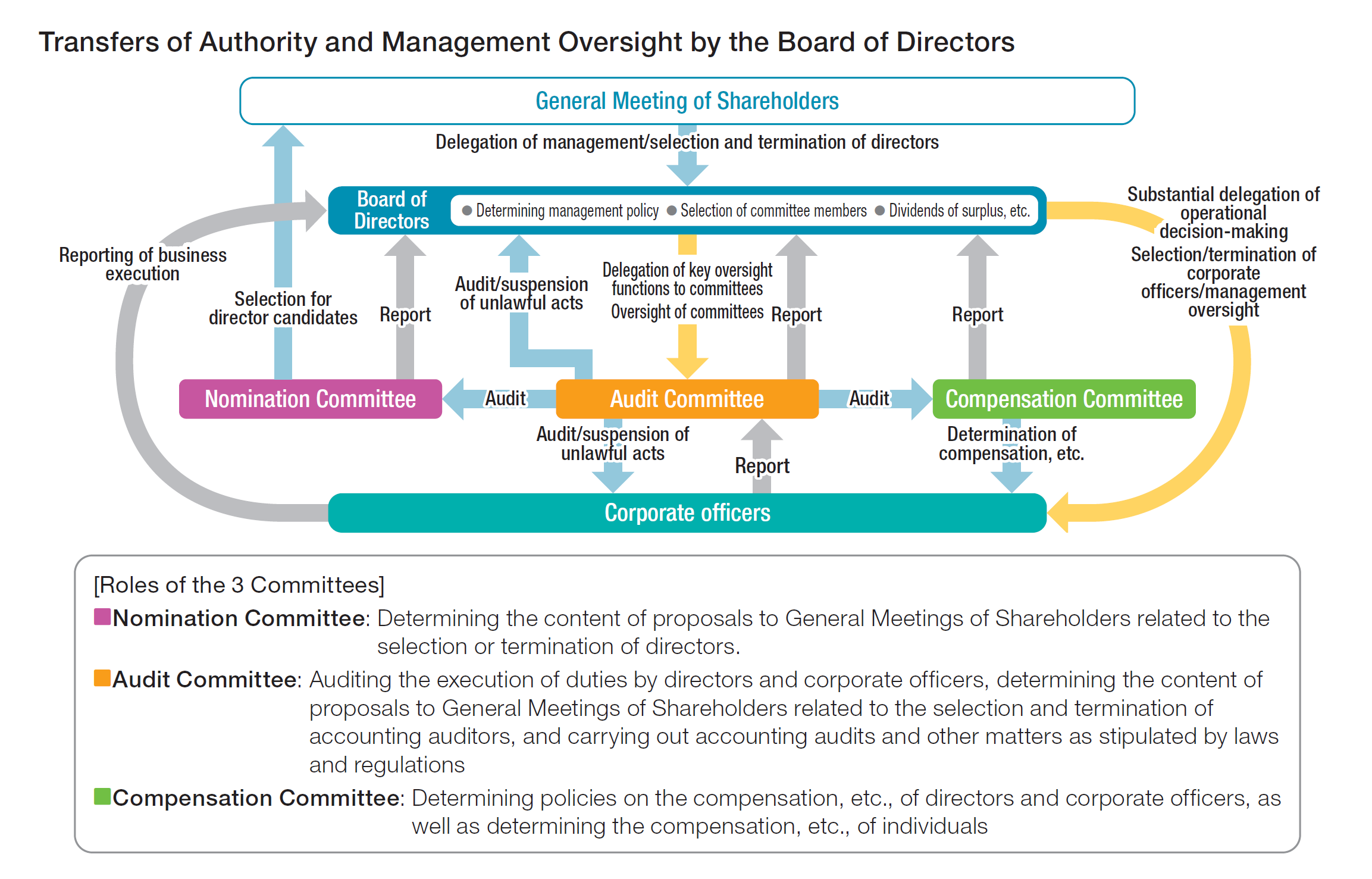

The Company fully leverages its system of being a company with a nomination committee, etc., with the Board of Directors entrusting a large portion of the decision-making authority over business execution to corporate officers to the extent permitted by laws and regulations in order to devote its attention to the oversight of management.

This enables prompt, flexible decision-making and business execution by corporate officers even in environments undergoing turbulent changes. Additionally, in order to achieve a clear separation between the oversight of management and the execution of business, the Company has established that the Chair of the Company’s Board of Directors be an outside director and that the Representative Corporate Officer and CEO shall be the only individual to concurrently serve as a corporate officer and a director.

Clearly separating the oversight of management and the execution of business enhances corporate vitality.

The Board of Directors exercises the function of oversight from the perspective of stakeholders to ensure fairness and transparency in management.

Also, the Board of Directors passes resolutions on rules related to “systems for ensuring proper business operations,” and establishes the specific rules for internal controls that should be put in place and operated by corporate officers, in accordance with the stipulations of the Companies Act. In addition to the matters stipulated in those rules, corporate officers ensure their autonomy by establishing and operating internal control in their assigned duties, thereby increasing the speed and flexibility of business execution.

Under this structure, the Board of Directors also checks the status of execution of duties by corporate officers and inspects the appropriateness of the status of internal controls such as the business execution and decision-making processes from the perspective of shareholders and society.

Directors and corporate officers communicate with each other and build trust in executing their respective duties and fulfilling their responsibilities, working together to increase corporate value and contribute to the creation of social value. Mechanisms such as these are the characteristics of the Company’s corporate governance. - A Sustained, Autonomous Mechanism for Enhancement of Corporate Governance Centered on Independent Outside Directors

The presence of independent outside directors, who account for the majority of the Board of Directors, supports the effectiveness of the Company’s corporate governance structure. Therefore, in order to meet stakeholders’ expectations and enhance management oversight functions, we place the highest priority on independence and neutrality when selecting outside directors.

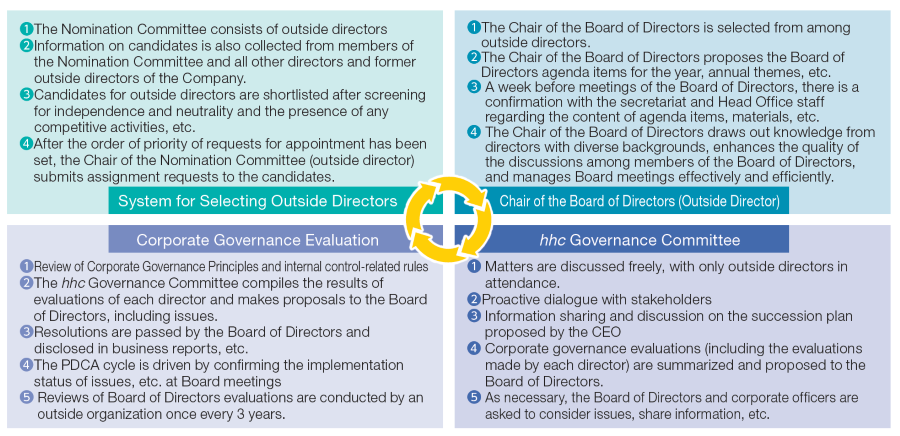

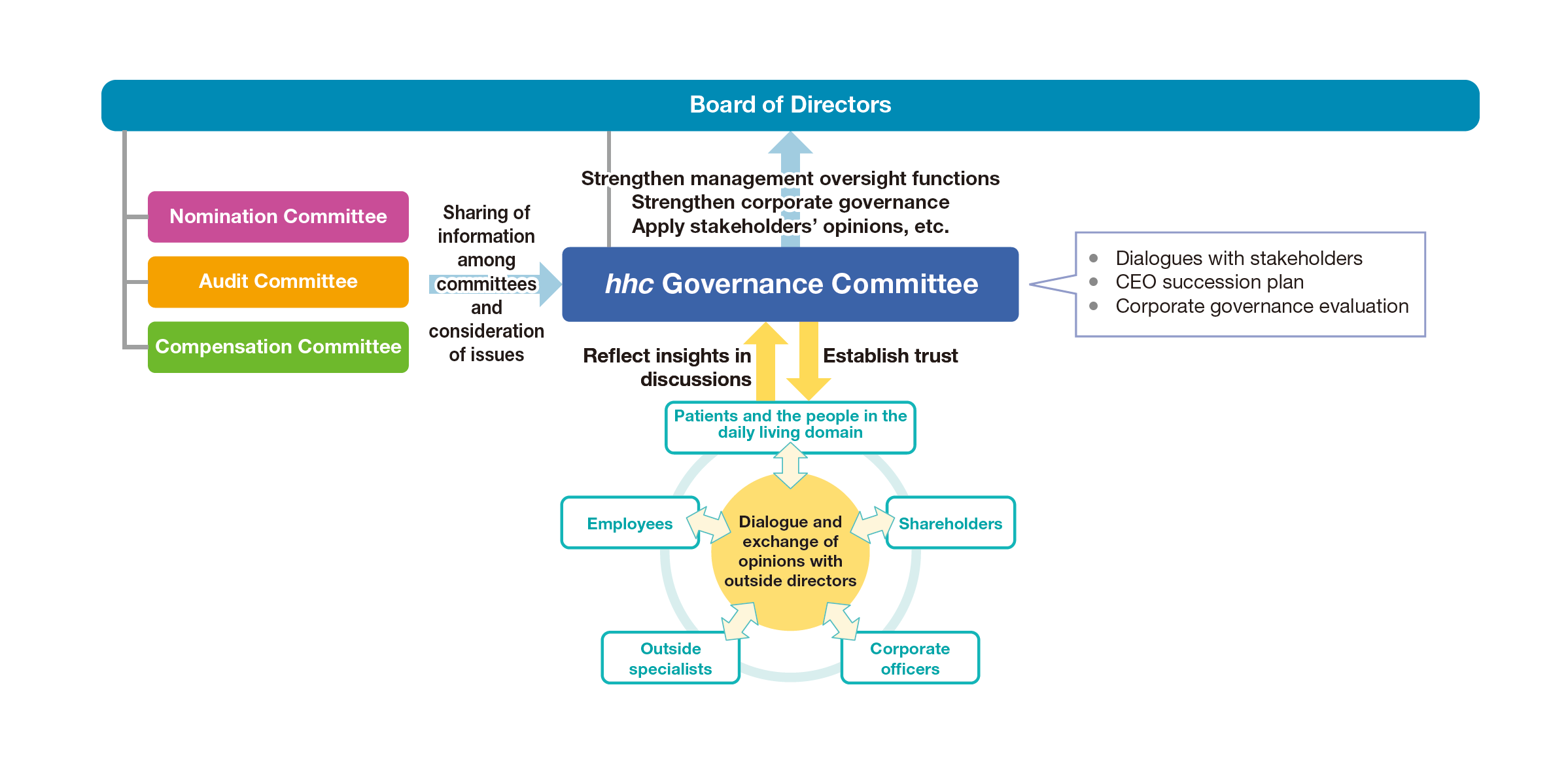

With independent outside directors at the center, the Company has established and is operating a mechanism to enhance sustained, autonomous corporate governance, including (1) a system of selecting neutral and independent outside directors by a Nomination Committee, (2) operating the Board of Directors, etc., through the leadership of a chair who is an outside director, (3) an hhc Governance Committee for broad discussion of corporate governance, including dialogues with stakeholders and the consideration of succession plans, etc., and (4) corporate governance evaluations through Plan-Do-Check-Act (PDCA) cycles of the Board of Directors and each committee. - Diversity of the Directors and Corporate Officers

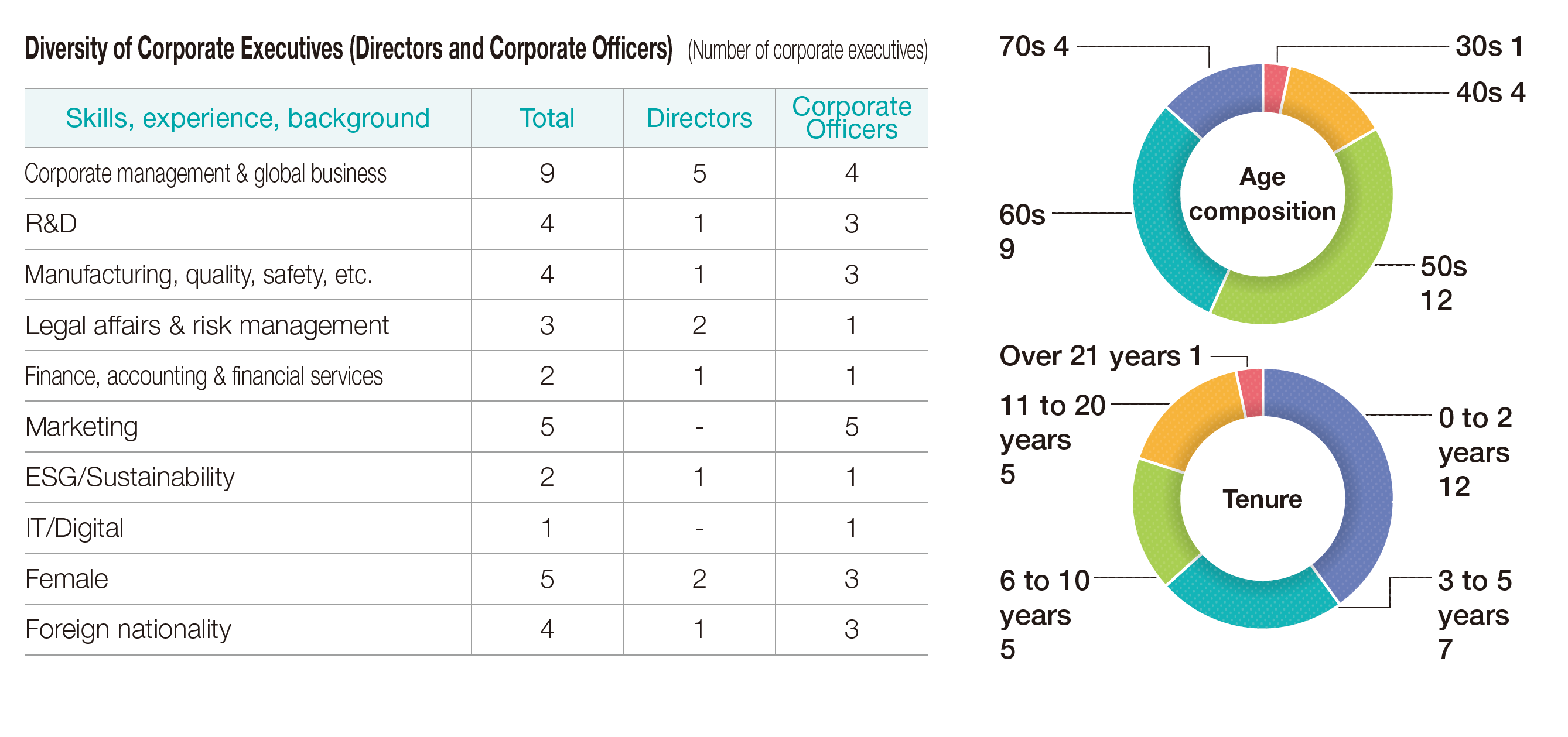

The corporate executives in a company with a nomination committee, etc., system comprise directors who perform management oversight and corporate officers who execute business operations. The table below describes the diversity among the corporate executives (directors and corporate officers) as of April 1, 2025.

The Nominating Committee believes that in order for the Board of Directors to exercise management oversight from the broad perspectives of stakeholders and external viewpoints, enhance corporate value and contribute to the creation of social value, it is of utmost importance that the Company be managed by corporate executives (directors and corporate officers) possessing a diversity of skills, experience and backgrounds, as well as nationality, gender, age, years in office andother characteristics.

The Board of Directors takes a global perspective in selecting the corporate officers who will implement our Corporate Concept and improve our corporate value, and assigns them in ways that allow them to effectively, efficiently harness their capabilities. As a pharmaceutical company, the Company selects its corporate officers among people who are well-versed in the operations in each field of business administration, including those with advanced expertise in R&D and the production, quality, safety, and other aspects of pharmaceuticals, as well as those with extensive knowledge in the medical systems and health care markets in particular regions of the world.

- System of Operational Divisions for Flexible Decision-Making and Business Execution

1) Meeting bodies in operational divisions such as advisory boards.

The Company has established the Corporate Strategy Committee and Growth & Operating Committee as mechanisms to support the decision-making of the CEO as the highest decision-making bodies of business execution, the Eisai Scientific Advisory Board (comprised of professors and researchers from world-renowned research institutions) for consideration of the direction of medium- to long-term R&D and general portfolio strategies and tactics, and the Sustainability Advisory Board (comprised of outside specialists from Japan and abroad who are well-versed in international policies) in order to improve our non-financial capital initiatives focused mainly on ESG and the Sustainable Development Goals (SDGs). Other meeting bodies include the Compliance Committee, the Risk Management Committee, the Sustainability Committee, and the Human Rights Awareness Committee.2) Building and Operating a Global Internal Control System

The Board of Directors has established the “Rules for Preparing Necessary Systems for Ensuring the Suitability of the Execution of Duties by Corporate Officers.” The corporate officers implement, maintain, and operate internal control systems in their assigned duties in accordance with the Rules. The Company also assigns global corporate officers, with the corporate officers who are in charge directly building and operating internal control systems at overseas subsidiaries.3) Instilling Management with Accountability and Stakeholder Consciousness

Once every 3 months, all corporate officers attend a Board of Directors meeting and report to the Board of Directors on decisions made in operational divisions, as well as the status of their business execution. Any other important matters or matters requiring reporting are presented to the Board of Directors on an as-needed basis. Corporate officers having accountability and reporting to the Board of Directors improves the rationality and transparency of decision-making, policies, and initiatives of operational divisions, while instilling stakeholder consciousness in management.

- Decision-Making and Management Oversight by the Board of Directors

Through the establishment of the best possible corporate governance and with the aim of realizing our Corporate Concept, the Board of Directors is entrusted with exercising its oversight functions and making the best decisions based on fair judgments. The Board of Directors makes decisions on basic management policies, the selection and dismissal of corporate officers, dividends, and other important matters as stipulated by laws and regulations, the Company’s Articles of Incorporation, and the Regulations of the Board of Directors. Meanwhile, in order to boost the agility and flexibility of business execution and increase management dynamism, the authority to make decisions on matters of business execution besides the aforementioned topics has largely been delegated to corporate officers.

The corporate officers tasked with business execution have the duty to present the Board of Directors with appropriate reports in a timely manner. The Board of Directors in turn confides in corporate officers by verifying the appropriateness and efficiency of business execution processes based on their reports while also evaluating the performance results of the business execution, thus fulfilling the role of management oversight by ensuring the appropriateness and efficiency of management.

In addition, the Nomination Committee, Audit Committee and Compensation Committee of the company with a nomination committee, etc., system have the right and responsibility to exercise oversight with respect to important management decisions such as the selection and termination of directors, audits and compensation for corporate executives. Furthermore, the Board of Directors exercises oversight over the execution of the duties of the committees based on reports from each of the committees.

1) Decision-Making Matters of the Board of Directors

The “Regulations and Detailed Rules of the Board of Directors,” which are disclosed here, prescribe the resolutions of the Board of Directors.

The Board of Directors determines important matters required by law, the Articles of Incorporation, and the Regulations of the Board of Directors, including basic management policies, the selection and termination of corporate officers, and dividends, etc. Depending on the proposal, some decisions are made following multiple meetings of the Board of Directors.

For example, decisions on annual business plans are made after a review of the progress made in the medium- to long-term business plan, a report on the basic policy of the business plan and its interim report, and other matters necessary for the resolution of the business plan outline. Furthermore, decisions on dividends are made after deliberations and resolutions are made on the basic policy of capital strategy, which revolves around securing ROE that exceeds the medium- to long-term cost of capital, stable and sustainable shareholder returns, and investment criteria for growth. Decisions on other matters, such as those related to financial results and the selection of corporate officers, are made after thorough discussions, with an awareness of accountability to our stakeholders.2) Management Oversight by the Board of Directors

❶A framework for overseeing the flexible decision-making of operational divisions

The Board of Directors is presented with timely and appropriate reports from operational divisions on decision-making matters related to the execution of their business and practices management oversight based on these reports. In addition, in order to further enhance the management oversight functions of the Board of Directors, the Company has introduced a system to enable directors to observe important decision-making bodies in the operational divisions, such as the Executive Board. This allows the Board of Directors to understand the decision-making process of operational divisions in a timely manner, even in situations requiring unplanned or emergency decision-making, enabling its oversight. In addition, the Board of Directors has a framework for gathering opinions and information from outside experts and organizations for the purpose of obtaining the information and bases necessary for the Board of Directors to make judgments and exercise its management oversight.

❷Management oversight via committees

In addition to the 3 committees required by law of a company with a nomination committee, etc., system (the Nomination Committee, Audit Committee and Compensation Committee), the Company has established the hhc Governance Committee—composed solely of outside directors—as a committee within the Board of Directors.

The hhc Governance Committee plays an important role in the Company’s corporate governance by sharing information and holding discussions on the succession plan, as well as preparing evaluation of the effectiveness of the Board of Directors. The committee also shoulders the responsibility of ensuring the continual enhancement of the Company’s corporate governance, strengthening the oversight functions of the Board

The hhc Governance Committee also works to eliminate information gaps between the members of the Nominating Committee, Audit Committee, and Compensation Committee by sharing information among the 3 committees in a timely manner, for example, by examining various issues raised by each of the committees.

❸Applying stakeholders’ opinions, etc., to management oversight

Outside directors play a central role in proactively engaging in dialogue with Eisai’s main stakeholders of patients and the people in the daily living domain, shareholders and employees. Once each year, the hhc Governance Committee reflects on its dialogue and engagement with stakeholders and deliberates on and confirms issues and matters to be addressed for the next fiscal year, while also incorporating insights gained from stakeholders into discussions and oversight by the Board of Directors.