- For Print

- May 13, 2013

Listed Company Name:Eisai Co., Ltd.

Representative:Haruo Naito Director, President & CEO

Headquarters:4-6-10 Koishikawa,Bunkyo-ku, Tokyo

Securities Code:4523

Listed Locations:First Sections of the Tokyo Stock Exchange

& the Osaka Securities Exchange

Inquiries:Sayoko Sasaki Vice President,

Corporate Affairs Phone 81-3-3817-5120

At the Compensation Committee meeting of Eisai Co., Ltd. (headquarters in Tokyo, President & CEO: Haruo Naito) held on May 13, 2013, a resolution was made to revise the compensation system for the Corporate Officers of the Company and to incorporate a new Performance-Related Stock-Based Compensation System (hereinafter “the System”) into the compensation system for such Corporate Officers. In addition, at the Board of Directors meeting held on the same day, a resolution was made for the disposal of treasury stock in accordance with the introduction of the System.

Remarks:

1. Introduction of the System

- (1)

The Company is a company with committees and the Compensation Committee thereof determines the compensation, etc., of Directors and Corporate Officers. The Compensation Committee of the Company, with the aim of achieving higher motivation for the Corporate Officers' execution of their duties, has revised the compensation system for its Corporate Officers so as to base it more on performance-related compensation. In accordance with this, in order to contribute to motivating Corporate Officers to enhance medium to long-term corporate value, the Compensation Committee has decided to incorporate a part of the salary-based compensation into the funding of this system and introduced this system under which the shares of the Company are to be distributed to Corporate Officers each year based on performance.

With the above revision and introduction of the system, the new compensation system for Corporate Officers is composed of “basic compensation”, a “bonus” (being performance-related monetary compensation), and “performance-related and stock compensation“.(See Note)

- (2)

For the Performance-Related Stock Compensation System, a system referred to as the Officers' Compensation BIP (Board Incentive Plan) Trust (hereinafter “the BIP Trust”) will be adopted. The BIP Trust is an Officers' incentive plan which is, in essence, the Japanese version of a Performance Share, with reference to the Performance Share System and Restricted Stock Compensation System in the U.S., and it is a type of compensation for Officers in which the Company's shares are distributed to the Corporate Officers based on the degree of attainment of performance objectives. It represents a mid- to long-term incentive plan in which the Company shares are distributed to the Corporate Officers based on the degree of attainment of performance objectives each year, and such system aims to motivate the Corporate Officers to share a common sense of interest with all of the Shareholders and to achieve higher corporate performance and stock prices from the mid- to long-term perspectives of corporate management.

- (3)

Such stock will be distributed to the Corporate Officers each July during the term of the Trust.

- (Note)The Stock Option System, which formerly constituted an element of the Directors' and Corporate Officers' compensation system, is no longer incorporated in the Directors' and Corporate Officers' compensation system, as it was abolished as of the 2012 fiscal year. No stock options have been offered since such time. However, the period for exercising stock options already distributed to Directors, Officers and employees ends on June 20, 2022.

2. Outline of the System

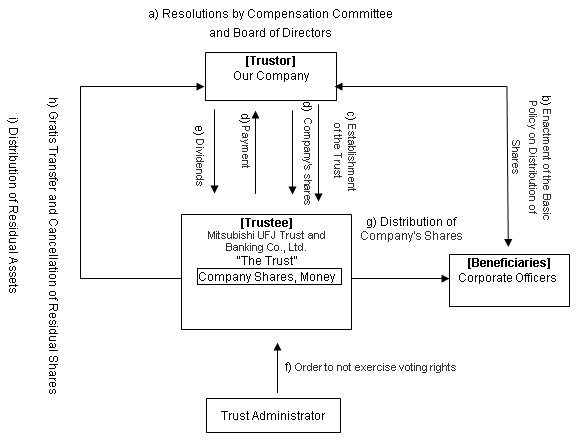

- a)Since the Company is a company with Committees, in introducing the System, the Compensation Committee first made a resolution to incorporate the BIP Trust into the Corporate Officers' compensation system, and then the Board of Directors made a resolution to dispose of the treasury stock in accordance with the System.

- b)The Company will then enact the Basic Policy on Corporate Officers' compensation with respect to the introduction of the System.

- c)The Company will entrust the money in accordance with the resolutions of the Compensation Committee and the Board of Directors as described in a) and establish a trust which will appoint as Beneficiaries those Corporate Officers who meet the Trustee requirements (such trust hereinafter the “Trust”).

- d)In accordance with the instructions of the Trustee, the Trust will receive the allotment of the Company's shares (disposal of treasury stock) by the principal funds money entrusted in accordance with item c). The number of shares the Trust is to acquire shall be set by way of resolution of the Board of Directors in accordance with the resolution of the Compensation Committee as described in item a).

- e)Dividends will be distributed with respect to the Company's shares within the Trust.

- f)Voting rights for the Company's shares within the Trust shall not be exercised during the Trust Period.

- g)In July of each year during the Trust Period, the Company's shares will be distributed to the Corporate Officers who meet the beneficiary requirements, based on Company-wide performance attainment for each fiscal year.

- h)If there are any residual shares left over upon the liquidation of the Trust, such shares will be transferred, gratis, from the Trust to the Company, and will be cancelled by way of a resolution of the Board of Directors.

- i)Upon the liquidation of the Trust, the residual assets, after the distribution to the Beneficiaries is completed to the extent that trust expense reserves remain after deducting the stock acquisition funds from the trust money, will belong to the Company. In addition, any amount in excess of the trust expense reserves will be donated to organizations which have no conflict of interest with the Company or the Company's directors or officers.

- (1)Outline of the System

The System allows the Company to annually distribute the Company' s shares to the Corporate Officers as compensation in accordance with the degree of attainment of Company-wide performance objectives set each fiscal year. The term of the System is for three years from the fiscal year ending on the last day of March 2014 and continuing to the fiscal year ending on the last day of March 2016.

- (2)Resolution of the Board of Directors and Resolution by the Compensation Committee relating to the introduction of the System

Since the Company is a company with Committees, the compensation of Directors and Officers is determined through the Compensation Committee. Therefore, for the introduction of the System, the Compensation Committee made a resolution to incorporate the BIP Trust into the Corporate Officers' compensation system, then the Board of Directors also made the necessary resolutions to determine the amount of money to be contributed to the Trust, the number of shares to be acquired by the Trust, and any other necessary matters.

- (3)Subjects of the System (Beneficiary Requirements)

The subjects of the System are the Corporate Officers of the Company, and by completing the prescribed procedures to confirm their status as Beneficiaries, they are eligible to receive the Company’s shares each July during the Trust Period on the condition that the following Beneficiary Requirements have been met:

a) During the Trust Period, the Corporate Officer must be a party to an engagement contract with the Company;

b) The Corporate Officer must not retire or resign from the Company during the term set forth in the Articles of Incorporation;

c) The number of shares to be distributed is determined by the Compensation Committee through the calculation formula set forth in item (5) below; and

d) The Corporate Officer must not commit certain types of misconduct. - (4)Trust Period

Three years, from May 29, 2013 (scheduled) to the end of July 2016 (scheduled).

- (5)Number of shares to be distributed to the Corporate Officers

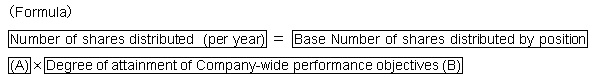

The number of shares to be distributed to the Corporate Officers is to be determined by the Compensation Committee based on the attainment of Company-wide performance objectives for each fiscal year, ending at the end of March, during the Trust Period, in accordance with the following formula:

- (A)“Base number of shares distributed by position” shall be calculated by dividing 10% of the total compensation for the particular Corporate Officer's position as determined by the Compensation Committee by the higher of (i) the average closing price for normal transactions (hereinafter the “Closing Price”) of the Company's shares on the Tokyo Stock Exchange on each day (except for days on which there were no transactions) belonging to the month in which the trust was established (May 29, 2013 (scheduled)) (rounded down to the nearest yen), or (ii) the Closing Price on the day on which the trust was established (if there is no Closing Price on such day, the Closing Price on the most recent prior transaction date).

- (B)“Degree of attainment of Company-wide performance objectives” shall be evaluated and calculated by the Compensation Committee by looking at the total amount of evaluation points calculated based on the achievement of the Company’s consolidated net sales, consolidated operating income, consolidated net income, and consolidated return on equity (consolidated ROE) each fiscal year. As a result, the number of shares to be distributed will be determined within the range of 0-150% of the “Base number of shares distributed”.

- (6)The amount of trust money to be contributed to the Trust and the number of shares to be acquired by the Trust shall be calculated as follows:

Amount of trust money to be contributed to the Trust:

JPY 489,850,000(*)- *The aggregate amount of funds for acquiring shares for the Trust, trust compensation, and trust expenses during the Trust Period.

Number of shares to be acquired by the Trust:

105,400 Shares

The amount of money to be contributed to the Trust will be calculated taking into consideration the amount of compensation of the Company's Corporate Officers as well as the trust compensation and trust expenses.

In the event of the money in the Trust falling short of the amount necessary to pay the trust compensation and trust expenses, an additional amount of money may be added to the Trust.

The number of shares to be acquired shall be set to the level required in the event of the highest attainment of Company-wide performance objectives, with reference to the present stock price level and the present composition of the Corporate Officers. - (7)The method of acquiring the Company's shares through the Trust

The initial acquisition of the Company's shares by the Trust is scheduled to be conducted by way of the disposal of the Company's treasury stock, in accordance with the number of acquired shares and amount of money for the share acquisitions stipulated in item (6) above.

- (8)The period of share distribution to the Corporate Officers

The share distribution period shall be each July during the Trust Period. By completing the prescribed procedures to confirm their status as beneficiaries, the Corporate Officers who meet the Beneficiary Requirements as described in item (3) above may receive, from the Trust, the distribution of the number of shares that the Compensation Committee has determined based on the attainment of Company-wide performance objectives.

- (9)Exercise of voting rights with regard to the Company's shares within the Trust

In order to ensure the neutrality of the Trust's management, the voting rights of the Company's shares in the Trust are not to be exercised during the Trust Period.

- (10)Handling of the dividends relating to the Company's shares within the Trust

The dividends for the Company’s shares in the Trust shall be received by the Trust, and shall be allocated towards the trust compensation and trust expenses.

- (11)Handling of the Trust at its expiration

If residual shares exist at the time of expiration of the Trust, as a means for sharing and boosting the earnings per share for the shareholders, a gratis transfer shall be conducted from the Trust to the Company and in accordance with a resolution of the Board of Directors the residual shares shall be cancelled.

Furthermore, with regard to dividends related to the Company's shares within the Trust, after such dividends have been dispersed to provide for the trust compensation and trust expenses, the balance at the time of expiration of the Trust shall be donated to organizations which have no conflict of interest with the Company or the Company’s directors or officers.

(Reference)

[Details of Trust Agreement]

*You can scroll to the left or right here

| a) Type of trust: | Monetary Trust other than a specified solely administered monetary trust (Third Party Beneficiary Trust) |

|---|---|

| b) Purpose of trust: | Granting incentives to the Corporate Officers of the Company |

| c) Trustor: | The Company |

| d) Trustee: | Mitsubishi UFJ Trust and Banking Corporation |

| e) Beneficiaries: | Corporate Officers satisfying the requirements to become Beneficiaries |

| f) Trust Administrator: | A third party having no conflict of interest with the Company (Certified Public Accountant) |

| g) Trust Agreement Date: | May 29, 2013 (scheduled) |

| h) Trust Period: | From May 29, 2013 (scheduled) to the end of July 2016 (scheduled) |

| i) System Commencement Date: | The System will start from May 29, 2013 (scheduled), and the distribution of the Company’s shares will start from July 2014 (scheduled) |

| j) Exercise of Voting Rights: | No voting rights shall be exercised |

| k) Types of Shares Acquired: | Company's common stock |

| l) Amount of Shares Acquired: | JPY 489,850,000 (including trust compensation and trust expenses) |

| m) Share Acquisition Date: | May 30, 2013 (scheduled) |

| n) Method of acquiring shares: | By way of disposal of the Company’s treasury stock |

| o) Rights Holder: | The Company |

| p) Residual Assets: | The residual assets that may be received by the Company, which is the rights holder, shall be within the trust expenses reserves equal to the trust money minus the amount for the share acquisition. |

[Details of the Trust and Company Share Related Administration]

| a) Trust Related Administration: | Mitsubishi UFJ Trust and Banking Co., Ltd. shall be the trustee of the trust BIP and shall conduct Trust related administration. |

|---|---|

| b) Company Share Related Administration: | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will conduct the administration related to the distribution of the Company shares to the beneficiaries based on the administration services contract. |